Around 4.1 million Americans will retire this year. Many will rightly anticipate a long and rewarding new chapter in their life — whether that means rest, study, adventure or family time. However, a financially comfortable retirement is closer to hand for some than for others.

Around two-thirds of America’s retirees fund these retirement years through savings or pensions, while 92% draw on Social Security to make ends meet. But among those yet to retire, 25% of them lack any retirement savings at all. More than one in ten over-65s lives in poverty. And single women and women of color are disproportionately represented among this number.

Over their lifetime, women face added challenges to their retirement saving strategy. Women earn just 84% of what men earn on average and live six years longer. They are statistically more likely to take time out of work to raise children or care for aging parents. When divorcing after 50, women can also expect a 45% decline in their standard of living, compared to 21% for men. And, once retired, women face the additional costs of living longer, such as increased healthcare fees and assisted living.

However, the cost of living, the gender wage gap and life expectancy all vary from state to state. Following our report on the cost for an American to comfortably retire around the world, we decided to uncover where across the U.S. women need to save the most for a comfortable retirement when compared to their male counterparts.

How We Conducted This Study

First, we used the average expectancy by gender in every state to estimate the average length of retirement locally. Next, we used MIT’s Living Wage Calculator to find the cost of living in each state, boosting this figure by 20% for a “comfortable” retirement. Using these figures, we calculated the retirement savings each gender needs in every state. Finally, we used census data to determine the average earnings by gender in every state and calculated how much longer women in each location need to work to reach their ideal retirement savings, assuming they spend nothing in those extra years of work.

Key Findings

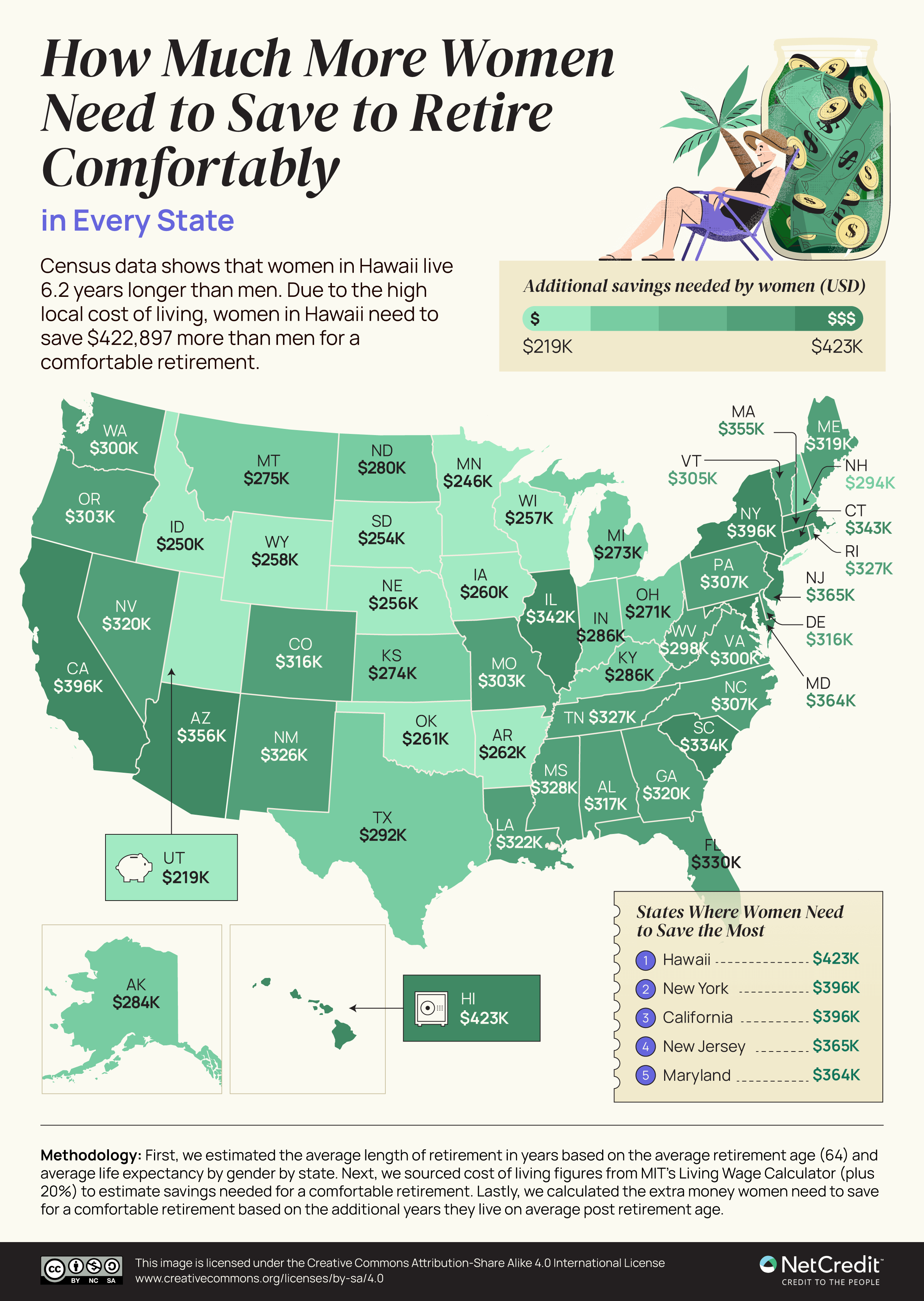

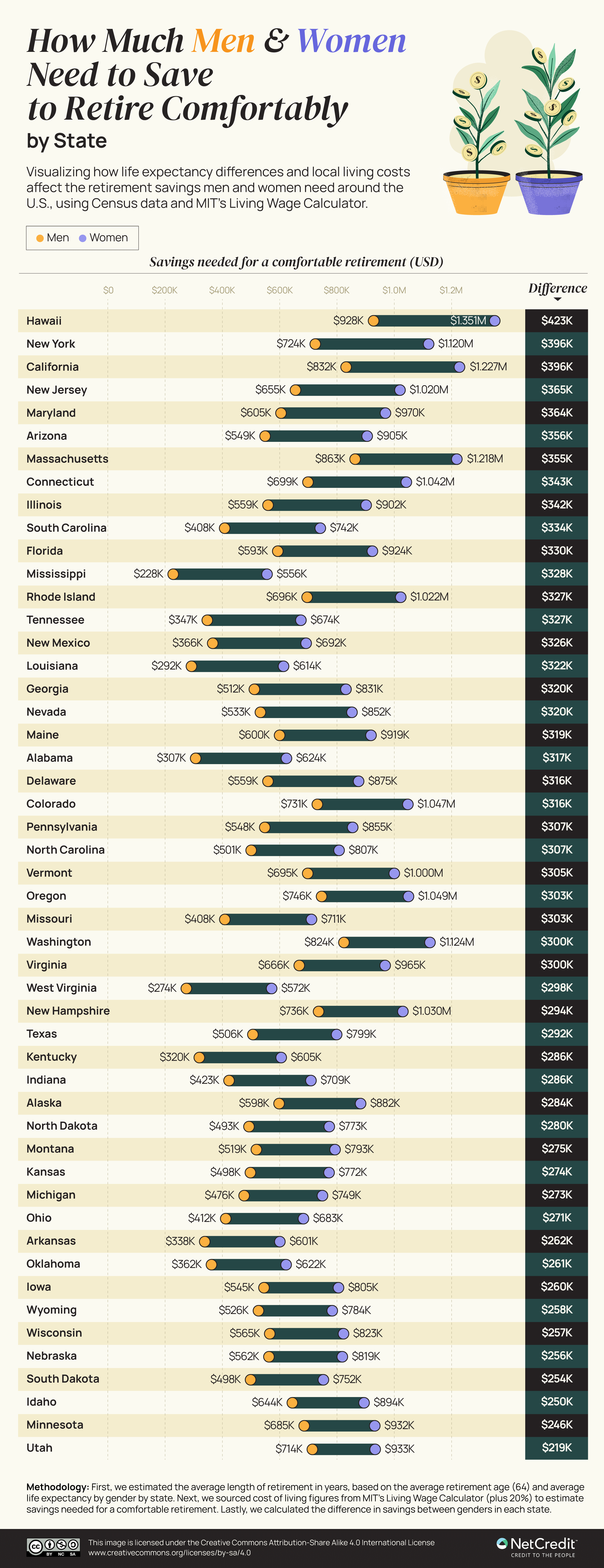

- In Hawaii, women need to save $1,350,542 for a comfortable retirement — more than anywhere else in the U.S.

- Women in Hawaii must work 11.23 years longer and save $422,897 more than men, the biggest disparity for any state.

- In New York, women need to save $395,616 more than men for a comfortable retirement — putting aside a total of $1,119,795.

Women in Hawaii Face Biggest Retirement Savings Gap

First, we calculated the average savings women need for retirement in every state, taking into account the local cost of living and life expectancy. Women in Hawaii live the longest of any state (19.8 years past retirement age) and face the second highest costs for living comfortably: $68,209 per year. This gives an ideal retirement savings figure of $1,350,542, the highest for women in any state.

In addition to living an average of 6.2 years longer than men, older women in Hawaii are more likely than not to be single, while the majority of men (around 70%) of this age are married. Being single often means sole responsibility for bills and housing costs. Across all age groups, single people in the U.S. spend an average of $48,000 each year, whereas married couples spend an average of $76,000. In Hawaii, 13.0% of single older women live in poverty, against just 4.1 % of married older women.

In addition to living an average of 6.2 years longer than men, older women in Hawaii are more likely than not to be single, while the majority of men (around 70%) of this age are married. Being single often means sole responsibility for bills and housing costs. Across all age groups, single people in the U.S. spend an average of $48,000 each year, whereas married couples spend an average of $76,000. In Hawaii, 13.0% of single older women live in poverty, against just 4.1 % of married older women.

Men in Hawaii also face steep living costs through their retirement years: an average of $927,645 to live comfortably. However, this figure is $422,897 less than that for women, the biggest gender disparity for any state (see diagram below).

Women in New York face the second biggest gap in the retirement savings needed compared to men, despite only having the fifth highest requirements overall. Men in New York should save $724,179 and women $1,119,795, a gap of $395,616. The gender pay gap in New York City has actually worsened over recent decades, despite improvements across the nation as a whole, although New York State has kept up with national figures.

Women in New York face the second biggest gap in the retirement savings needed compared to men, despite only having the fifth highest requirements overall. Men in New York should save $724,179 and women $1,119,795, a gap of $395,616. The gender pay gap in New York City has actually worsened over recent decades, despite improvements across the nation as a whole, although New York State has kept up with national figures.

“[M]any women find themselves in a cycle of unfairly low pay throughout their working lives,” says Letitia James, New York State Attorney General. “Being paid less can weaken a woman’s ability to provide for herself or her family, purchase a home, or save for retirement… The pay gap is even worse for women of color: In New York, Black women are paid only 63 cents and Latina women receive only 56 cents for each dollar paid to white men.”

It Takes Longer for Women to Save for Retirement in Southeastern States

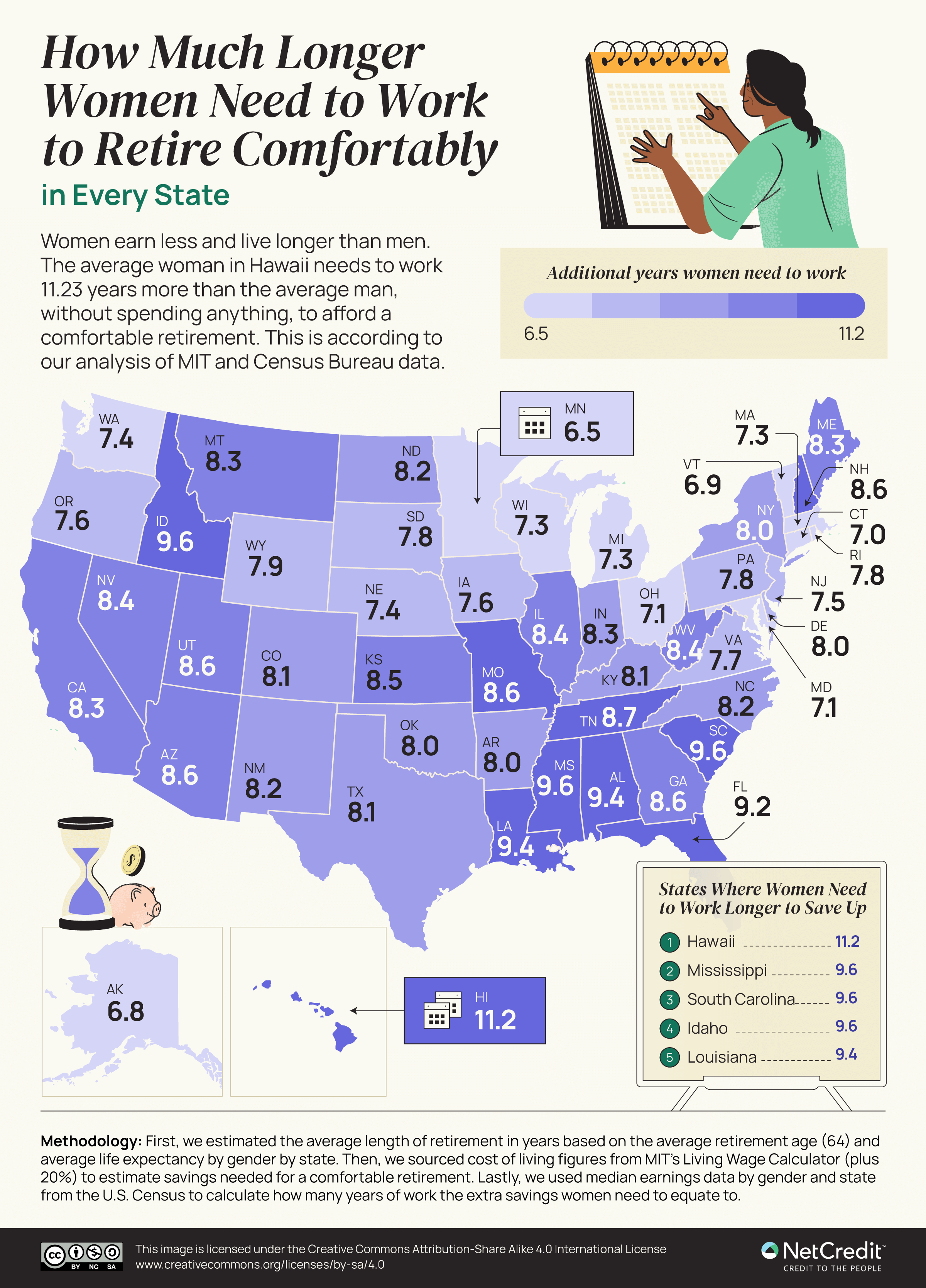

Next, we used average local earnings and cost of living data to figure out how many more years women theoretically need to work to comfortably retire in every state — assuming they save every penny earned in those extra years.

Women in Southeastern states are among those who need to work the longest, compared to men. Mississippi and South Carolina are within a few decimal points of each other, with the average woman needing to work around 9.63 years longer than local men to save for retirement. Mississippi became the last U.S. state to enact an equal pay law in 2022.

Women in Hawaii face the steepest challenge, again: needing to work 11.23 years longer than men to afford a comfortable retirement. This is due to the local wage gap and a retirement period that may last nearly 20 years. The long life expectancy of both women and men in Hawaii may put added pressure on middle-aged women to balance caring for their elders and preparing for their retirement years.

Women in Hawaii face the steepest challenge, again: needing to work 11.23 years longer than men to afford a comfortable retirement. This is due to the local wage gap and a retirement period that may last nearly 20 years. The long life expectancy of both women and men in Hawaii may put added pressure on middle-aged women to balance caring for their elders and preparing for their retirement years.

“Women know how dangerous it is to leave the workforce, and we know it’s not something that many of us can afford,” says Liz O’Donnell, author of Working Daughter: A Guide to Caring for Your Aging Parents While Making a Living. “The average family caregiver is a woman in her late 40s and early 50s. If that woman takes her foot off the gas pedal in her career, does she ever get back in?”

Preparing for a Comfortable Retirement

The issue of retirement savings may feel most urgent to those closest to the end of their working life, but younger savers face additional challenges on top of those of today’s retiring boomers. The average millennial, rather than saving, carries $30,558 of debt (not including mortgage debts) and faces steeper living costs along the way as housing costs rise faster than wages.

As such, it is never too soon to start thinking about your retirement strategy and the breakdown of the pension plan, account savings and social security it might encompass. You can browse our state-by-state data on the income, cost of living and longevity disparities facing men and women in every state in this interactive table

While planning for the long term is essential, everybody knows that life has its unexpected ups and downs, financially, health-wise and in family matters. Saving for retirement, then, is not a simple case of sitting on a nest egg but checking in and adjusting your plans as conditions change over the years.

Says income strategist Diane Garnick: “People would not think about going through an entire year without meeting their physician, and saying, “I’m here for my annual checkup. Confirm that I’m on the right track and that I’m doing okay.” Yet many people don’t sit down at least once a year with a financial advisor and say, “Give me that financial checkup. How am I doing?” If you don’t take a good look at your finances, there’s almost no easy way for corrective action, particularly later on in life.”

Methodology

First, we estimated the average length of retirement in years, based on the average retirement age of 64 and the average life expectancy by gender by state. Next, we sourced the cost of living in each state for a single adult from MIT’s Living Wage Calculator.

Then, we multiplied the state living wage by the average retirement years for each gender in all states. To estimate a more comfortable retirement, we increased these savings figures by 20%. We calculated the difference in savings between genders in each state, based on all the data above.

Lastly, we used median earnings data by gender and state from the U.S. Census to calculate how many years of work the extra savings women need to equate to.

This study was completed in October 2024

DISCLAIMER: The calculations above are intended to highlight the discrepancy between wages for women when compared to men as well as the additional cost women have to incur due to a longer life expectancy. These figures are not intended to be used as a basis for retirement planning. The results of our analysis will show that in most cases, women will need to work X amount of years more than men, however, our calculations are based upon people saving 100% of their earnings, which in reality would be highly unlikely. This means that the ‘X amount of years extra needed to work’ referenced in our findings above should not be used as a practical figure to plan toward but instead as an illustrative guide to the difference in savings needed between the genders for a comfortable retirement.

DISCLAIMER: This content is for informational purposes only and should not be considered financial, investment, tax or legal advice.